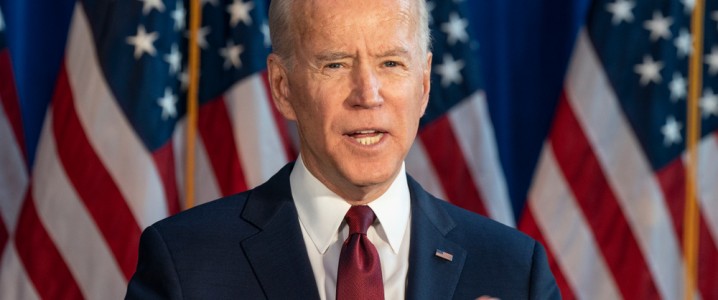

Has Biden Brought An End To U.S. Energy Independence?

The march towards energy independence began 10 years ago, and oil and gas imports have been shrinking ever since.

Though there have been some snags in the movement towards energy independence, the trajectory is clear.

The impact of the COVID-19 demand destruction has weighed on the industry, but the blip will likely be temporary in the long run.

I get quite a lot of correspondence from readers. Some of it involves angry messages from readers who are convinced that reality is something other than I have presented.

For example, in my recent articles (and in a Facebook post that went viral), I detailed the underlying causes for the current surge in oil, and subsequently gasoline prices.

President Biden has passed policies that could negatively impact domestic oil supplies in the future. However, thus far the price surge is primarily a result of 3 million barrels per day (BPD) of oil production that was lost in the spring of 2020 that hasn’t fully recovered. Demand has fully recovered, so that is the fundamental reason for the surge in prices. Further, that surge began in the fall of 2020 — five months before President Trump left office.

But some people are looking for simple answers. Since Joe Biden is now president, and they recognize his hostility to the oil and gas industry, they reason that it’s a no-brainer that this is primarily Biden’s fault. And some of the angry feedback I get reflects that.

One person recently messaged me “Then why are we no longer energy independent, genius?” First, note that I am not going to engage with anyone who approaches me in a hostile or disrespectful manner. I do, however, sometimes engage people who simply disagree and want to express their opinion.

Yet this person raised a question that reflects a belief I have seen expressed many times. That is that President Trump made us energy independent, and now under President Biden we have lost that energy independence. Once again, the truth requires a bit more discussion.

What Is Energy Independence?

The first thing I ask when someone poses this question is “How are you defining energy independence?” In reality, most people are using it incorrectly. A correct accounting would be to add up all of our energy production (oil, natural gas, coal, renewables) and then subtract our net energy consumption.

Why do I say “net”? Because if we import a million barrels per day of oil, and export that as roughly a million barrels per day of finished products, it doesn’t actually impact our energy independence — even though it increases our gross overall consumption.

Most people view energy independence through the lens of our oil and gas production and consumption. These two sources represent 68% of U.S. energy consumption. When they see our net exports are positive, it is viewed as “energy independence.” When they turn negative, we are once again partially dependent. (In reality, we are always partially dependent, because even when our exports exceed our imports, we are still importing oil from other countries).

It is true that in 2019 our net imports of crude oil and finished products flipped from positive to negative. By that metric, we became energy independent (at last as far as our oil consumption goes). It is also true that Donald Trump was president when this happened for the first time in October 2019.

The Long March Toward Independence

But note that this was the culmination of a trend that started in 2006 when U.S. net imports topped 13 million BPD. Most of that march to energy independence happened under President Obama. All President Trump (and President Obama before him) had to do was avoid driving the bus into the ditch, and they would continue to benefit from the hydraulic fracking boom that enabled all of this.

Note near the end of the chart above that we started oscillating back and forth between a net importer and a net exporter. The Covid-19 pandemic disrupted the trend. The energy independence that we gained in 2019, was lost in the second half of 2020 as energy production plunged, but energy demand recovered. In May 2020, we had flipped back to a net oil importer, and we have oscillated since.

To be clear, I am not giving credit (or blame) here to President Obama or President Trump. Their policies weren’t responsible for the underlying plunge in our crude oil imports, which is the primary factor in our march to energy independence.

However, one thing President Obama did that helped oil production continue to expand under President Trump was in the energy bill he signed in late 2015. One stipulation in that bill allowed domestic producers to export their oil. To that point, finished products like diesel and gasoline could be exported, but not crude oil. That depressed U.S. oil prices, which benefitted refiners but not oil producers.

This comprehensive energy bill that President Obama signed helped open up new markets for domestic oil producers, who had suffered from depressed prices due to their inability to export their oil. That stipulation — which was a trade-off for getting some renewable energy provisions — helped extend the fracking boom. Prior to 2015, U.S. oil exports were insignificant. By 2019, we were exporting 3 million BPD of crude oil.

Are We Energy Independent?

The Energy Information Administration (EIA) tabulated U.S. energy consumption in 2019 and 2020 and determined that for both full years, counting all energy sources, we were energy independent. Even though U.S. energy production declined by 5% in 2020, energy consumption also declined by 3% as the pandemic impacted the economy. So, our energy independence was shrinking as the pandemic unfolded.

As I noted above, the EIA wrote:

“Annual crude oil production generally decreased between 1970 and 2008. In 2009, the trend reversed and production began to rise, and in 2019, U.S. crude oil production reached a record high of 12.25 million barrels per day. More cost-effective drilling and production technologies helped to drive the production increases, especially in Texas and North Dakota. U.S. crude oil production declined to about 11.31 million barrels per day in 2020. A large drop in U.S. petroleum demand in March and April 2020 as a result of the response to the Covid-19 pandemic led to a decrease in U.S. oil production.”

So, in 2009 we began the march to energy independence. Those wishing to credit President Trump for this need to take another look at that net imports graphic to grasp the full picture.

But we don’t actually know if, once the full year of 2021 has been accounted for, we lost our energy independence for the year. If it turns out that we did, the single largest factor in that will be that oil and natural gas production have yet to return back to pre-Covid-19 levels. But demand has recovered, and therein lies the reason.